Investment Team Voices Home Page

Investment Team Voices Home Page

International Growth Opportunities in Focus

Nick Niziolek, CFA, Dennis Cogan, CFA, Paul Ryndak, CFA, and Kyle Ruge, CFA

Summary Points:

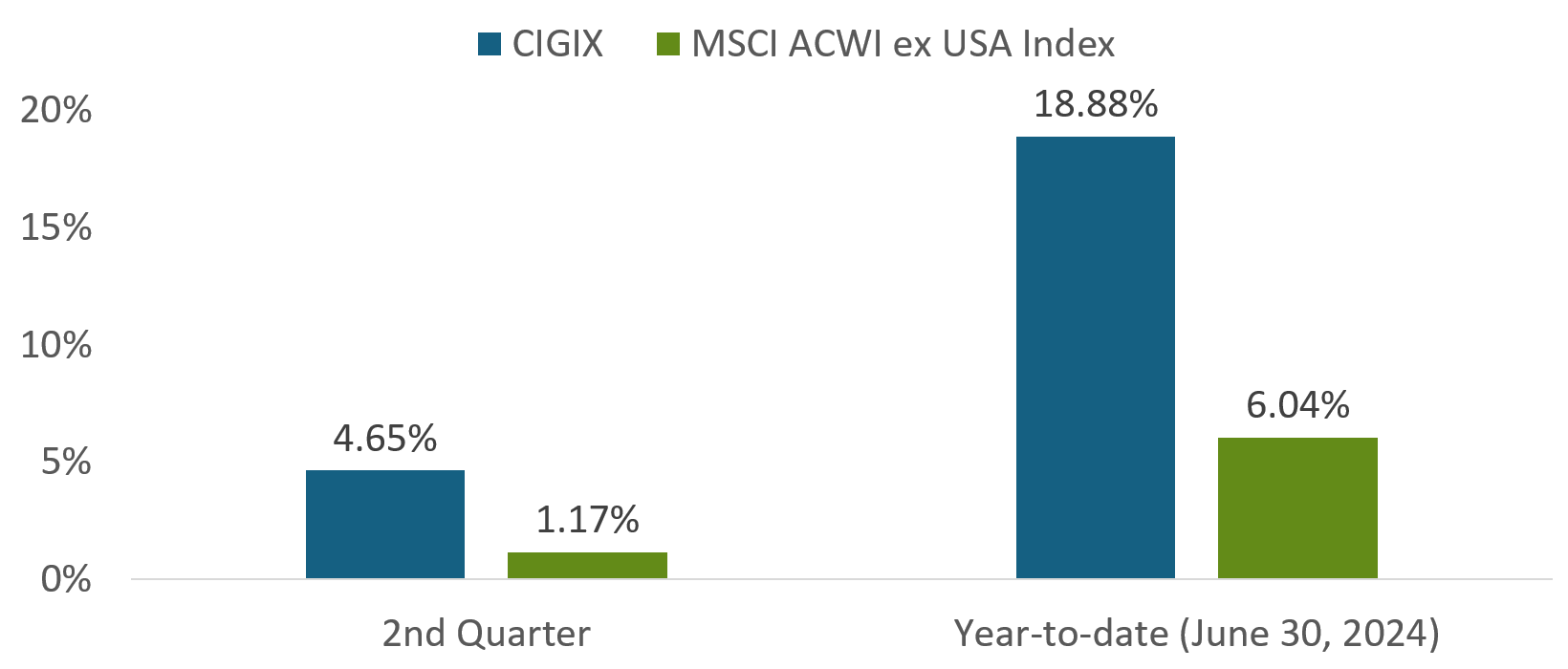

- Calamos International Growth Fund’s returns for the quarter and year-to-date exceeded the MSCI ACWI ex-USA Index.

- CIGIX’s positioning aligns with our view that the economy is in a disinflationary growth market cycle regime, an environment that provides abundant tailwinds for our thematically oriented growth approach

- We are active growth investors, with our positioning in India and industrials exemplifying our high-conviction approach.

International equity markets added to year-to-date gains during the second quarter, even though economic data regarding the growth and inflation outlook remained mixed. Emerging market equities performed with notable strength during the quarter: The MSCI Emerging Markets Index’s return of 5.1% outpaced the MSCI ACWI ex-USA Index (up 1.2%), and the MSCI World Index (up 2.8%).

Calamos International Growth Fund Has Performed Strongly in 2024

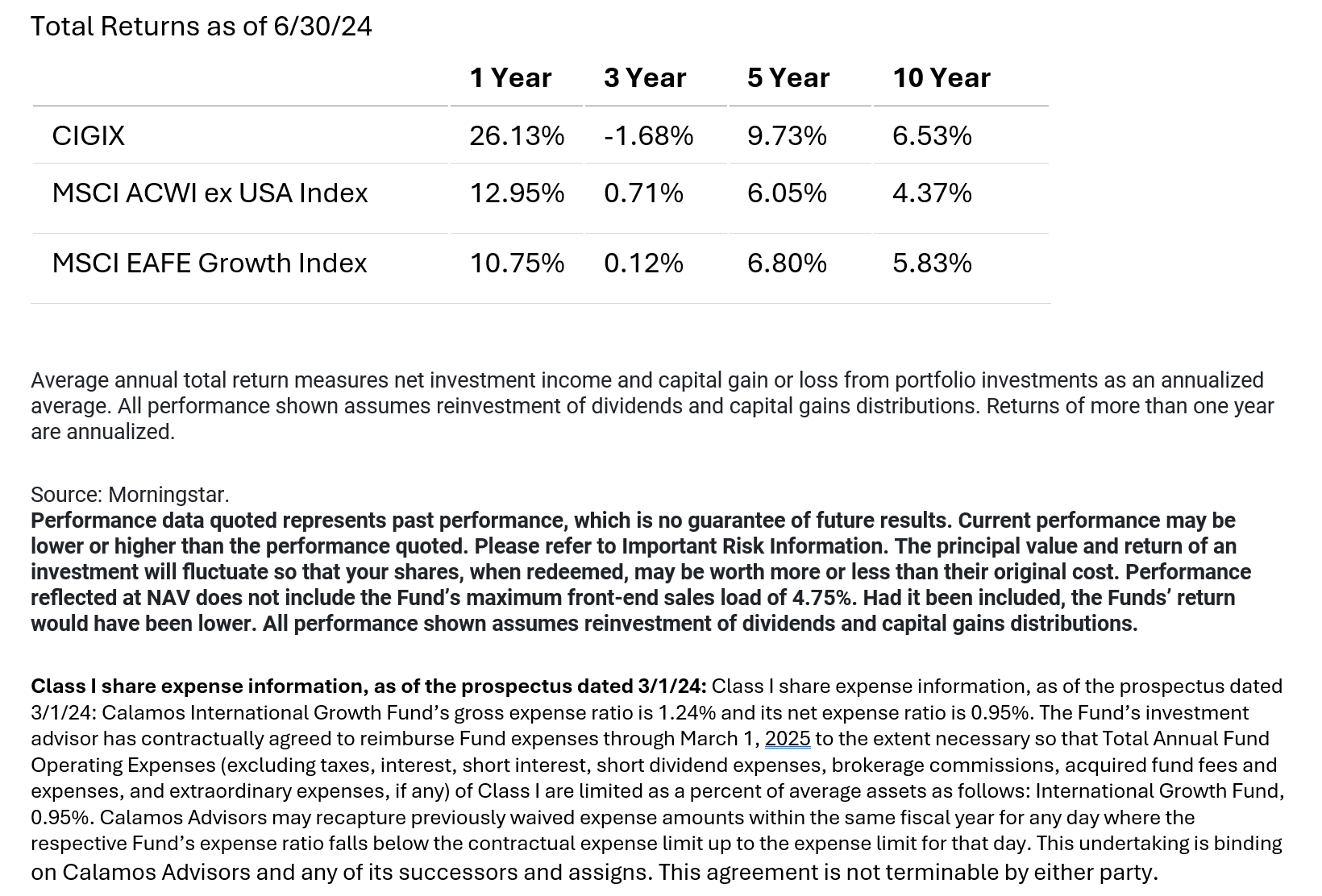

Source: Morningstar.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. Please refer to Important Risk Information. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load of 4.75%. Had it been included, the Fund’s return would have been lower. All performance shown assumes reinvestment of dividends and capital gains distributions. As of the prospectus dated 3/1/2024, CIGIX’s gross expense ratio is 1.24%.

Peak Covid re-opening tailwinds and peaks in inflation and accelerating growth are all in the rearview mirror for most major economies. Even so, we believe the global economy is resilient overall, and recession is not our base case. Regarding our macro framework, we believe we are in a period of disinflationary growth characterized by decreasing inflation and decent economic fundamentals, which is a generally benign backdrop and an ideal environment for growth equities, including those with secular tailwinds. Below, we highlight some key positioning themes within Calamos International Growth Fund:

Japan: Targeting Pockets of Opportunity

Japan is our second largest allocation on absolute basis as of June 30, 2024. We recently returned from a research trip to Japan, which included company tours, meetings with senior management teams, and spirited debates and discussions with some of our peers. Although the tone from company management teams was generally optimistic and investor interest in Japanese equities is high, we are mindful of changing sentiment within the domestic economy. In 2023, we were struck by how the average worker was cheering inflation—and the significant wage gains inflation fueled. However, the realization that inflation is eroding purchasing power is sinking in. This new reality is likely to have knock-on effects on consumer-driven sectors of the economy.

Consequently, although the combination of valuations, improved corporate governance, and a focus on optimizing capital allocation supports our optimistic view of Japan’s equity market, we have emphasized global companies domiciled in Japan because these multinationals can also benefit from the continued unfolding of the global capex cycle.

Another cause for optimism within the Japanese equity market centers on the success of recent retirement savings reforms, which have led to increased investments in local and overseas markets. New savings plans create a steady flow of capital from the retail segment into the capital markets and have also increased the average person’s interest in the markets. We believe this higher engagement will help drive additional reforms and incentivize companies to be shareholder-friendly.

Industrials: A Closer Look

Our exposure to the industrial sector is multi-dimensional, spanning secular, turnaround/capital improvement, and more cyclical names. Reflecting the sector’s breadth of opportunity, the Fund’s allocation to industrial companies is its largest and more than double that of the MSCI ACWI ex USA Index. The secular opportunities for data center infrastructure are among the most exciting for the sector. Both power and thermal equipment will see an uptick in demand because AI chips and servers use three to four times more electrical power than traditional central processing units. According to the IEA, global data center total electricity consumption is expected to double from 2022 to 2026.

For more on CIGIX:

The Best Kept Secret in Global Investing

Identifying Global Growth Opportunities Through a Thematic LensAs overall electricity consumption rises, new infrastructure investments will be made inside data centers (e.g., new servers, cooling equipment, and additional power supplies) and outside the centers to expand power generation and transmission to meet demand.

Our overweight also reflects the bottom-up fundamentals in many industrial companies, including improved operational efficiencies, margins, and cash flows; and new management teams committed to strengthening competitive positioning. Japan-domiciled companies are well represented within our industrial holdings, where country-specific factors provide new catalysts for management teams to improve operational efficiencies, eliminate noncore holdings, and return capital to shareholders—a welcome shift after years of stagnant corporate evolution.

Votes Are In: India’s Growth Story Is Intact

The fund’s largest country weighting is to India, with an overweight that is more than triple the weighting within the MSCI ACWI ex USA Index. We’ve been bullish on India for quite some time, where the encouraging economic and policy reforms championed by Prime Minister Narendra Modi are just one of many catalysts. Although India’s equity market hit a bit of an air pocket after recent national election results diverged from exit-poll expectations, we believe India’s growth story and investment cycle are strong.

While Modi won his third straight term as prime minister and a ruling coalition led by the incumbent Bharatiya Janata Party (BJP) and a second party held the majority, the BJP lost seats. Although this contributed to a selloff in Indian equities immediately following the election, the market has since steadied and regained ground.

We believe pre-election policies are likely to stay on track. Major post-election ministry appointments should provide continuity of policy direction, with ministerial heads of Roads & Highways, Railways, Home, Defense, and Ports all retained by the BJP. Moreover, the government-mandated crop price implemented post-election aligned with the average hike over the past decade, easing concerns that the government would implement populist policies to appease the rural population. Additionally, there could be some positives resulting from the structure of the current coalition government, including a lower chance of constitutional and sweeping policy changes. The coalition may act as a check to keep the BJP honest in doing what it has said it would do.

Accordingly, our long-term thesis on India hasn’t changed. The investment cycle continues, and the government’s healthy fiscal position can support existing policy direction. The fund continues to access India’s growth primarily through real estate and capex-driven industries that will benefit from the continuation of the investment cycle and government policies that encourage infrastructure and manufacturing growth. We have also identified opportunities in consumer-facing industries that can benefit from India’s favorable demographic trends, such as the rapid growth of the country’s middle-class and working-age populations.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. MSCI EAFE® Growth Index measures developed market growth equity performance (excluding the US and Canada). The MSCI ACWI ex USA Index represents performance of large- and mid-cap stocks across developed and emerging markets excluding the United States.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk: As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

900240 0624

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.